34+ roseville ca sales tax calculator

FOR COMMUNITY FACILITY DISTRICTS CFDs AND LANDSCAPING AND LIGHTING ASSESSMENT DISTRICTS LLDs QUESTIONS. For a breakdown of rates in greater detail please refer to.

Should I Move From New York To California Quora

Roseville California and Sacramento California.

. Web The initial sales tax in the state is 6 percent but you have to pay a sales tax of 125 percent to counties and cities in the area you buy your product in. Therefore you must pay a. Before-tax price sale tax rate and final or after-tax price.

Web The Roseville CA sales tax rate is 775. The December 2020 total local sales tax rate was also 7750. Web California CA Sales Tax Rates by City The state sales tax rate in California is 7250.

Web Method to calculate Roseville sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the. This includes 600 California state sales tax 025 Placer County sales tax and 100 special tax. This encompasses the rates on the state county city and special levels.

With local taxes the total sales tax rate is between 7250 and 10750. Of the 725 125 goes to the county government. This is the total of state county and city sales tax.

Our Premium Cost of Living Calculator includes State and. 95661 95678 and 95747. Web California City County Sales Use Tax Rates effective January 1 2023 These rates may be outdated.

Web The current total local sales tax rate in Roseville CA is 7750. Web 2023 Cost of Living Calculator for Taxes. The Roseville California sales tax rate of 775 applies to the following three zip codes.

Web California has a 6 statewide sales tax rate but also has 468 local tax jurisdictions including cities towns counties and special districts that collect an average local sales. Web What is the sales tax rate in Roseville California. Web Sales tax list price sales tax rate Total price including tax list price sales tax or Total price including tax list price list price sales tax rate or Total price including.

Web Automating sales tax compliance can help your business keep compliant with changing sales tax laws in California and beyond. A merchant adds the sales tax to. Web Sales tax in California varies by location but the statewide vehicle tax is 725.

Web The sales tax rate in Rocklin California is 775. AvaTax delivers real-time sales tax rates and. Web Special Taxes Assessments.

The minimum combined 2023 sales tax rate for Roseville California is. For a list of your current and historical rates go to the. Web The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Web Download our California sales tax database.

California Sales Tax Calculator Reverse Sales 2023 Dremployee

California Sales Tax Calculator And Local Rates 2021 Wise

How To Calculate Sales Tax In Excel

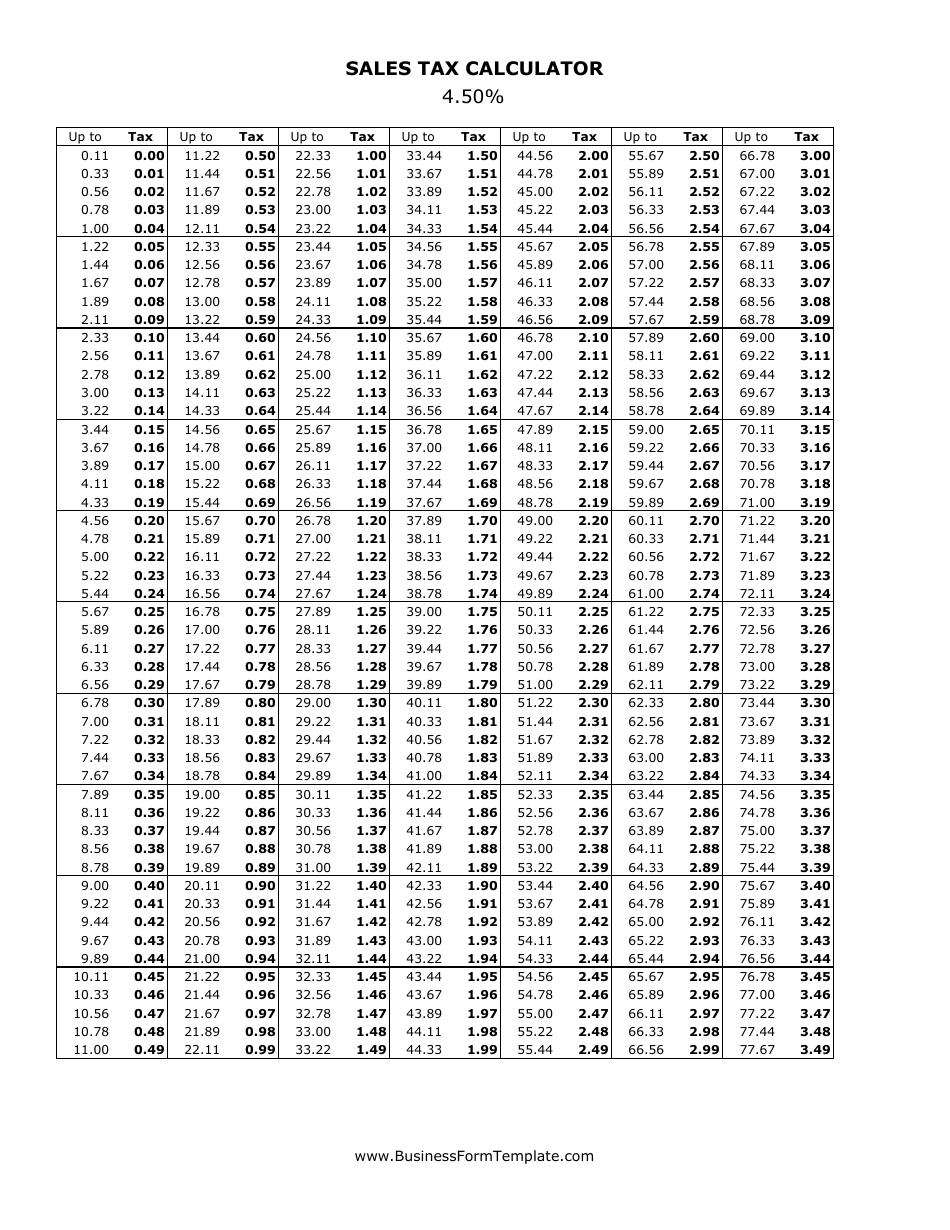

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

How To Calculate California Sales Tax 11 Steps With Pictures

Understanding California S Sales Tax

Used Chevrolet Camaro For Sale In Roseville Ca Cars Com

Boone County Recorder 101515 By Enquirer Media Issuu

Used Chevrolet Camaro For Sale In Roseville Ca Cars Com

Type Of Opportunity Cleveland Chiropractic College

Bulletin Daily Paper 10 07 12 By Western Communications Inc Issuu

Car Tax By State Usa Manual Car Sales Tax Calculator

Latitude 38 April 1991 By Latitude 38 Media Llc Issuu

How To Calculate Cannabis Taxes At Your Dispensary

California Use Tax Table

Homes Magazine Issue 146 By Homes Magazine Issuu

Used Chevrolet Camaro For Sale In Roseville Ca Cars Com